This month, Freddie D considers off piste ski safety and mountain awareness - how much do you really know!

Stay Covered and Shred the Powder: The Importance of Off-Piste Ski Insurance

When it comes to skiing and snowboarding insurance, the question of off-piste cover is the biggest and most common question we are asked by our adventure travel enthusiasts. Venturing off the beaten track (or piste) comes with its fair share of risks. That's where the question of off-piste ski insurance comes into play and the importance of having proper coverage cannot be stressed enough, accidents or unexpected incidents can happen at any time whether on or off piste.

At Snowcard we understand the thrill and enjoyment that skiing off-piste brings but our main aim is to ensure that you can pursue your passion with peace of mind. A Snowcard policy with off-piste ski insurance is designed to protect you from unforeseen emergencies, including rescue, medical expenses, and repatriation back home to the UK.

With a Snowcard policy you can hit the slopes confidently, knowing that you are covered and our long term customer-driven approach to meeting the needs of our clients means that we have tailored our policies to meet the needs of most recreational winter sports enthusiasts, providing you with the level of protection needed on the slopes.

Understanding the risks involved in off-piste skiing

Off-piste skiing, also known as backcountry skiing, involves skiing on unmarked and unpatrolled slopes, away from the designated ski areas. While it offers a sense of freedom and adventure, it also comes with inherent risks.

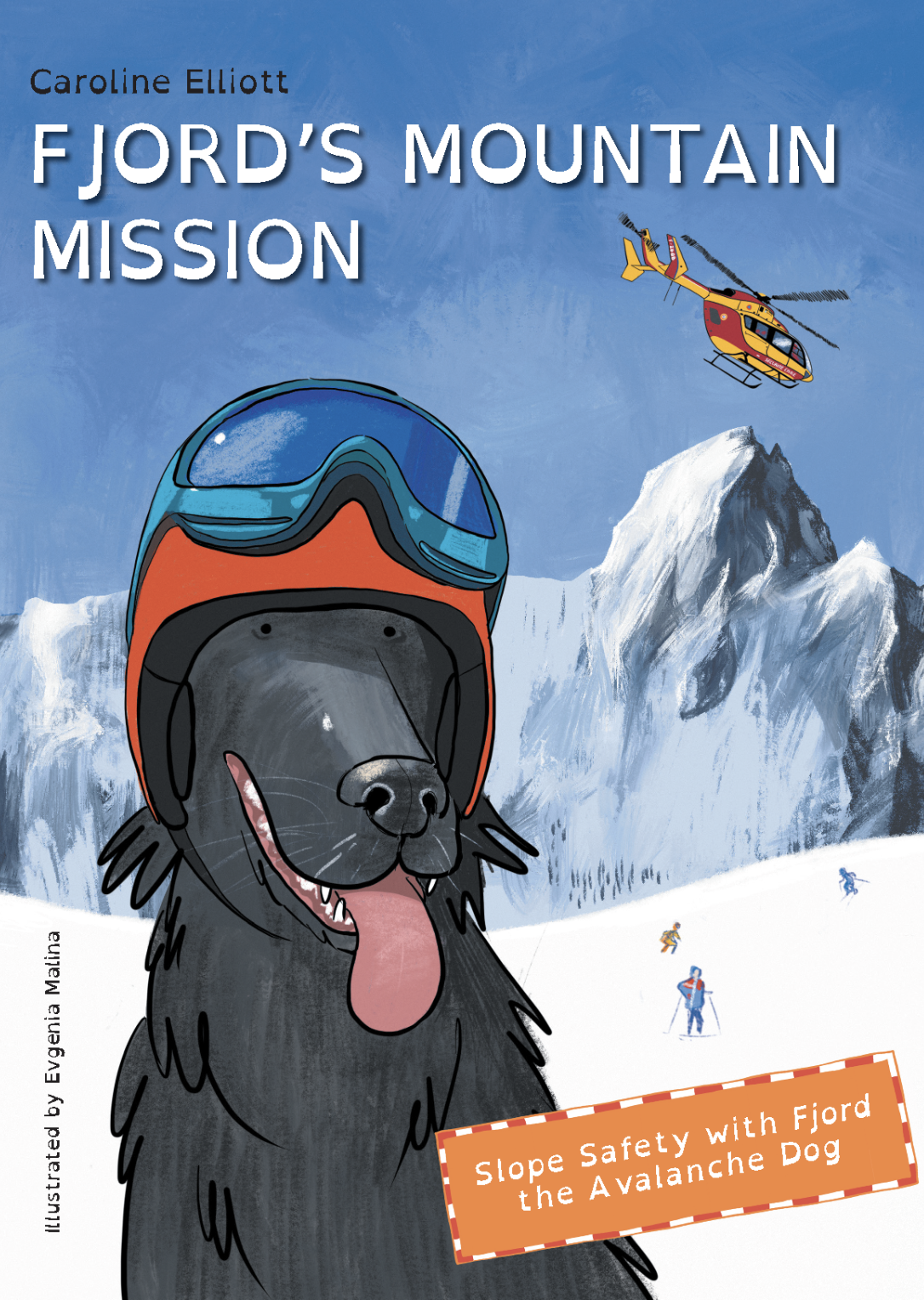

Snowcard have recently been asked to sponsor a series of mountain skills awareness seminars run by search and rescue expert Caroline Elliott at FjordSAR. Caroline is passionate about mountain safety and has written a book aimed at educating young and upcoming mountain sports enthusiasts. Her hope is to ensure the next generation heading into the mountains, whether off piste skiing or boarding or to climb and trek have the awareness and skills to stay safe. For Snowcard, this is a no brainer, better awareness, more training and enhanced skills equals fewer accidents and injuries.

One of the main risks of off-piste skiing is the potential for avalanches. The backcountry terrain is often unstable, and heavy snowfall can trigger avalanches, posing a significant threat to skiers. Additionally, there is a higher risk of encountering hidden obstacles, such as rocks or tree stumps, which can lead to accidents and injuries. Long time experts in the field of avalanche awareness and safety, Henry’s Avalanche Talk, are big favourites of Snowcard with their championing of the education and training of off piste skiers and boarders.

Weather conditions also play a crucial role in off-piste skiing risks. Changes in weather, such as sudden snowstorms or high winds, can affect visibility and increase the chances of getting lost or disoriented. Moreover, the remote nature of off-piste skiing means that access to medical facilities and rescue services may be limited, Henry’s Avalanche Talk provides valuable insight into how the weather can affect slope stability and no one should venture off piste without a basic understanding of how slope stability causes avalanche and how taking advice from locals before heading off piste will literally save your life.

It's crucial for off-piste skiers to understand these risks and take necessary precautions to ensure their safety. However, even with the utmost care, accidents can still occur. That's why having off-piste ski insurance is vital to protect yourself from the unexpected but just as importantly, having the right equipment. Snowsafe.co.uk have an excellent off piste safety check list.

The importance of off-piste ski insurance

Whilst off-piste ski insurance serves as a safety net, providing financial protection and peace of mind while you enjoy your off-piste adventures, it is no replacement for being prepared and understanding the risks of off piste skiing and snowboarding.

Off-piste ski insurance should cover you for rescue operations. In the event of an accident or emergency, the insurance policy will cover the cost of search and rescue teams, helicopter evacuations, and transportation to the nearest medical facility. These expenses can be substantial, unfortunately, most general non-specialist policies will not provide this level of protection.

In summary, off-piste ski insurance is essential for anyone venturing into the backcountry. It safeguards you against potential financial losses and ensures that you have access to the necessary resources in case of emergencies.

Key features to look for in an off-piste ski insurance policy

When it comes to off-piste ski insurance, not all policies are created equal. It's essential to understand the key features to look for to ensure that you are adequately covered. Here are some important factors to consider:

1. Coverage for off-piste skiing: Make sure the policy explicitly covers off-piste skiing and not just skiing within the resort boundaries. Off-piste skiing involves additional risks, and your insurance policy should reflect that.

2. Rescue and medical coverage: Check for comprehensive coverage that includes rescue operations, medical expenses, and emergency transportation. Look for policies that provide generous coverage limits to ensure you won't face any unexpected out-of-pocket expenses.

3. Equipment coverage: Evaluate the policy's coverage for equipment damage, loss, or theft. Ensure that the coverage extends to your ski gear, including your skis, boots, bindings, and other accessories.

4. Liability coverage: Verify that the policy includes liability coverage, protecting you in case you cause harm to others or their property while skiing off-piste. This coverage is crucial for your financial and legal protection.

5. 24/7 emergency assistance: Look for policies that provide round-the-clock emergency assistance services. Having access to a dedicated helpline can make a significant difference when you need immediate help in a remote location.

By considering these key features, you can find an off-piste ski insurance policy that meets your specific needs and provides the necessary coverage for your adventures. But how do you choose the right off-piste ski insurance provider?

Tips for choosing the right off-piste ski insurance provider

Choosing the right off-piste ski insurance provider is just as important as selecting the right policy. Here are some tips to help you make an informed decision:

1. Research and compare: Take the time to research different insurance providers and compare their policies. Look for reputable companies with a track record of providing excellent customer service and reliable coverage.

2. Read customer reviews: Read online reviews and testimonials from other skiers who have used the insurance provider's services. Pay attention to their experiences with filing claims and the company's responsiveness in handling emergencies.

3. Evaluate the coverage limits: Compare the coverage limits offered by different providers. Ensure that the limits are sufficient to cover potential expenses, especially for rescue operations and medical treatments.

4. Consider the deductibles: Check the policy's excess’s, which refer to the amount you need to pay before the insurance coverage kicks in. Lower deductibles may mean higher premiums, so find the right balance that suits your budget.

5. Understand the exclusions: Familiarize yourself with the policy's exclusions to know what is not covered. Some policies may exclude certain activities, pre-existing conditions, or high-risk regions. Make sure you understand the limitations before making a decision.

6. Check for additional benefits: Some insurance providers offer additional benefits such as trip cancellation coverage, equipment rental reimbursement, or coverage for pre-paid ski passes. Consider these extra perks when comparing different providers.

7. Seek recommendations: Ask fellow skiers, friends, or travel agents for recommendations on reliable off-piste ski insurance providers. Personal recommendations can provide valuable insights and help you make an informed choice.

By following these tips, you can narrow down your options and choose an off-piste ski insurance provider that best meets your needs.

Common misconceptions about off-piste ski insurance

There are several misconceptions surrounding off-piste ski insurance that may discourage skiers from getting the coverage they need. Let's address these misconceptions and set the record straight:

1. Misconception: Regular travel insurance covers off-piste skiing: Many skiers assume that their regular travel insurance policy will cover off-piste skiing. However, most standard travel insurance policies exclude high-risk activities like off-piste skiing. It's important to have a dedicated off-piste ski insurance policy to ensure proper coverage.

2. Misconception: I don't need off-piste ski insurance if I'm an experienced skier: While experience can certainly reduce the risk of accidents, it doesn't eliminate them completely. Accidents can happen to anyone, regardless of skill level. Off-piste ski insurance provides a safety net, no matter how experienced you are.

3. Misconception: Off-piste ski insurance is too expensive: The cost of off-piste ski insurance varies depending on factors such as coverage limits, deductibles, and the provider you choose. However, the potential financial risks of not having insurance far outweigh the cost of the policy. It's a small price to pay for peace of mind.

4. Misconception: Off-piste ski insurance is only for extreme skiers: Off-piste skiing is not limited to extreme skiers. It encompasses any skiing activity outside the marked and patrolled slopes. Whether you're a beginner exploring backcountry trails or an experienced skier seeking fresh powder, off-piste ski insurance is essential for your safety.

5. Misconception: Off-piste ski insurance is unnecessary if I have medical insurance: While having medical insurance is important, it may not provide the same level of coverage as a dedicated off-piste ski insurance policy. Off-piste ski insurance offers specific benefits tailored to skiing-related risks, including rescue operations and equipment damage.

By dispelling these misconceptions, it becomes clear that off-piste ski insurance is a necessity for anyone venturing into the backcountry. But what if you find yourself in a situation where you need to make a claim with your off-piste ski insurance? Let's explore the process in the next section.

How to make a claim with your off-piste ski insurance

In the unfortunate event of an accident or emergency while skiing off-piste, it's important to know how to make a claim with your off-piste ski insurance. Here are the general steps involved in the claims process:

1. Notify your insurance provider: Contact your insurance provider as soon as possible to report the incident and initiate the claims process. They will guide you through the necessary steps and provide you with the required documentation.

2. Gather supporting documents: Collect all relevant documents to support your claim, such as medical reports, police reports (if applicable), receipts for medical expenses, and any other supporting evidence. Make sure to keep copies of these documents for your records.

3. Fill out the claim form: Complete the claim form provided by your insurance provider. Be thorough and accurate when providing details about the incident, including the date, time, location, and a description of what happened. Attach the supporting documents to the claim form.

4. Submit the claim form: Submit the completed claim form along with the supporting documents to your insurance provider. Follow their instructions for submission, whether it's through email, mail, or an online portal. Retain copies of all documents for your reference.

5. Cooperate with the claims adjuster: Your insurance provider may assign a claims adjuster to assess your claim. Cooperate fully with the adjuster, providing any additional information or documentation they request. Be responsive and timely in your communication.

6. Follow up on the claim: Stay in touch with your insurance provider to track the progress of your claim. If you have any questions or concerns, don't hesitate to reach out to them for clarification. Keep a record of all interactions and correspondence related to your claim.

By following these steps and maintaining clear communication with your insurance provider, you can ensure a smooth and efficient claims process. However, prevention is always better than cure.

Other safety measures to consider for off-piste skiing

While off-piste ski insurance provides crucial financial protection, it's important to take additional safety measures to minimize risks while skiing in the backcountry. Here are some safety tips to keep in mind:

1. Get appropriate training: Acquire the necessary skills and knowledge for off-piste skiing. Take lessons or hire a qualified instructor to learn proper techniques for skiing in variable terrain and dealing with potential hazards.

2. Ski with a buddy: Skiing off-piste alone is not recommended. Always ski with at least one other person and keep each other in sight. In case of an accident or emergency, having a buddy can make a significant difference in getting timely help.

3. Carry essential safety equipment: Always carry essential safety equipment, including an avalanche transceiver, a shovel, and a probe. Learn how to use each item properly and regularly practice with them to maintain familiarity.

4. Stay informed about weather and avalanche conditions: Stay updated with weather forecasts and avalanche bulletins for the area you plan to ski. Avoid skiing during high-risk conditions and be aware of signs of unstable snow, such as recent avalanches or cracks in the snowpack.

5. Plan your route and inform others: Before heading out, plan your route and share it with someone you trust. Let them know your expected return time and check-in with them upon your safe return. This ensures that someone is aware of your whereabouts in case of an emergency.

6. Stay within your abilities: Be honest with yourself about your skiing abilities and do not push beyond your limits. Off-piste skiing requires advanced skills and experience. Gradually progress to more challenging terrain as you gain confidence and experience.

7. Respect local regulations and guidelines: Familiarize yourself with any local regulations or guidelines for off-piste skiing in the area you plan to visit. Adhere to the rules and respect private property boundaries to ensure a safe and enjoyable experience for everyone.

By following these safety measures, you can enhance your off-piste skiing experience while minimizing risks.

Conclusion: Protecting yourself and enjoying the slopes safely

You might be wondering, why not just rely on regular travel insurance when skiing off-piste? While regular travel insurance can provide some level of coverage, it often falls short when it comes to the unique risks associated with off-piste skiing.

Off-piste ski insurance is specifically designed to address the hazards and challenges that skiers face when venturing into unmarked terrain. It typically offers coverage for emergency medical expenses, including helicopter rescue and evacuation, which can be astronomically expensive without insurance.

Regular travel insurance, on the other hand, may have limitations or exclusions when it comes to extreme sports or activities such as off-piste skiing. It's crucial to carefully review the policy terms and conditions to ensure that you have the necessary coverage in case of an accident or emergency.

By opting for off-piste ski insurance, you can have peace of mind knowing that you have comprehensive coverage specifically tailored to the risks associated with off-piste skiing. Don't leave your safety and financial well-being to chance – invest in the right insurance coverage and enjoy your off-piste adventures worry-free.